california mileage tax bill

But opponents are concerned the legislation is laying the groundwork for a permanent mileage tax. The new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate effective at the start of 2022.

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Workers who use their personal vehicles for business purposes will have to track their mileage.

. I dont want to sell my home but it is time. For conventional vehicles that burn gasoline the State will boost revenue through a 012-per-gallon gas-tax increase. DeMaio is leading the statewide fight through his Reform California campaign committee to block the Mileage Tax from being imposed - and hes targeting most of his efforts to block the first Mileage Tax pilot project in San Diego county.

Registered vehicle owners in California will be eligible for at least 400 per vehicle totaling 9 billion in direct payments to millions of Californians. The IRS provided legal guidance on the new rates in Announcement 2022-13 PDF issued today. California also pumps out the highest state gas tax rate of 6698 cents per gallon followed by Illinois 5956 cpg Pennsylvania 587 cpg.

To get that better mileage. Since 2015 the program allows the state to study a road user charge based on vehicle miles traveled as an alternative to fuel taxes. These new rates become effective July 1 2022.

For the last half of 2022 both the IRS and the California Department of Human Resources suggest mileage reimbursement rates of 0625 per mile. The bill would require that participants in the program be charged a mileage-based fee as specified and receive a credit or a refund for fuel taxes or electric vehicle fees as specified. Vermont and Washington enacted bills to study per-mile fees in 2012.

Traditionally states have been levying a gas tax. WASHINGTON The tens of millions of Americans living near Superfund sites could soon get some welcome news. The California Legislature has passed a bill that authorizes a pilot program for a vehicle miles traveled tax.

The vehicle miles traveled tax has been proposed as a potential. 1 day agoCalifornia cuts cannabis taxes to aid struggling industry. By Go By Truck News September 11 2014.

Officials say that amount accounts for. Drivers would be able to opt out of tracking their mileage and pay a flat annual fee of 400 a provision that would expire in 2030. Today this mileage tax.

California is the second state to test mileage fees in recent years joining Oregon which launched a pilot program of its own in 2014. California Expands Road Mileage Tax Pilot Program. October 1 2021.

California will be losing another tax payer between all taxes to the statecounty I pay about 12kyear. The California legislature passed a bill extending a road usage charge pilot program. I have been resisting against all common sense leaving California completely.

They then report the. Jerry Brown has received legislation that would make California the third West Coast state to test replacing state fuel tax with a vehicle-miles-traveled fee. This means that they levy a tax on every gallon of fuel sold.

The sweeping health care and climate change bill the House is expected to pass. California lawmakers are considering a per mile tax It would raise money for roads and bridges by replacing the state gas tax with a fee based on the miles you drive. California recently authorized its own mileage tax pilot project.

Jerry Brown signs SB1077 the state will create a task force that will develop the pilot. Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program. Have found Florida to be much.

California relies on gas tax and other fuel tax revenues to fund its roadway maintenance and repairs. Now the California legislature is looking at a voluntary program that would eliminate the states gas tax which currently stands at 529-cents. The money so collected is used for the repair and maintenance of roads and highways in the state.

Tags Fuel tax Gas Tax Highway bill Vehicle miles traveled tax. 2 billion in relief for free public transportation for three months pausing a portion of the sales tax rate on diesel and suspending the inflationary adjustment on gas and diesel excise tax. Instead of paying at the pump when purchasing fuel a mileage tax system determines a.

Californias Proposed Mileage Tax California has announced its intention to overhaul its gas tax system. The Mileage Tax would be the death blow to many families pricing them out of our state said DeMaio. 10 They both increased the reimbursement rate 4 cents from the first half of 2022.

Carl Demaio Spearheads Signature Drive In San Diego To Stop Tax Hikes

Everything You Need To Know About Vehicle Mileage Tax Metromile

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune

What Would A Vehicle Mileage Tax Mean For Ride Share

A Primer On Vehicle Miles Traveled Taxation Concepts California Globe

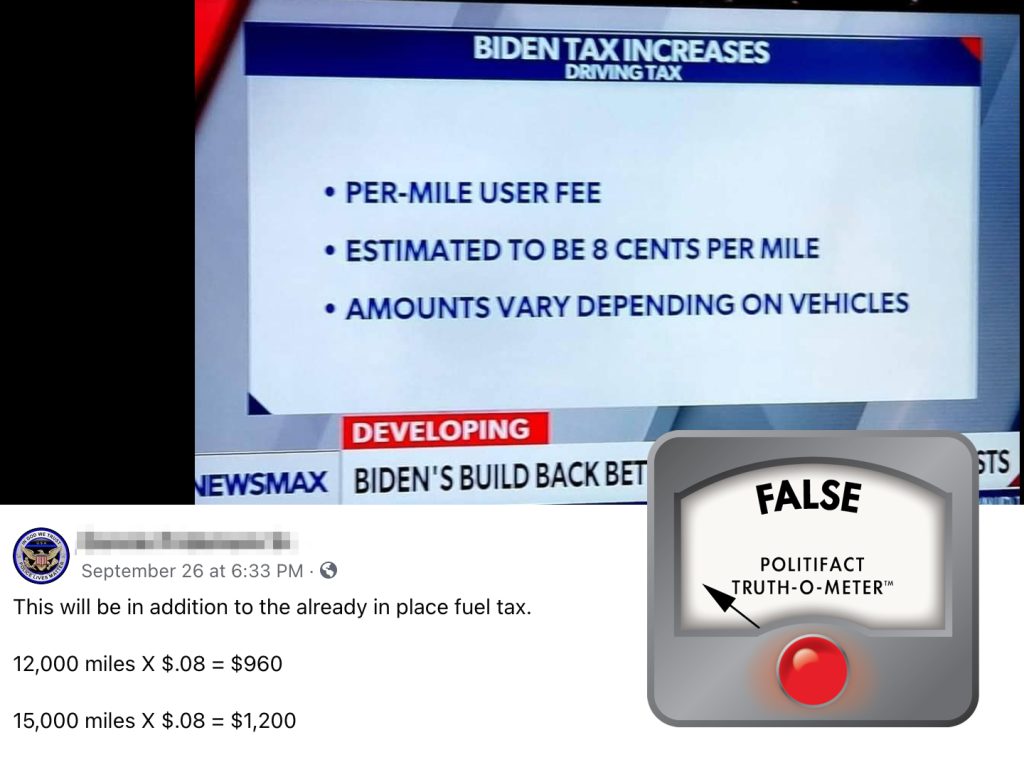

Politifact Biden Infrastructure Plan Wouldn T Establish A Per Mile Driving Tax Nbc 6 South Florida

Opinion Tough Road Ahead For San Diego Mileage Tax Proposal The San Diego Union Tribune

Paying By The Mile For California Roads Infrastructure Capitol Weekly Capitol Weekly Capitol Weekly The Newspaper Of California State Government And Politics

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Opinion Mileage Tax Plan San Diegans Debate Per Mile Charges For Drivers The San Diego Union Tribune

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

What Are The Mileage Deduction Rules H R Block

Sandag Approves Mileage Tax Over Objections Of Unfairness To East County East County Magazine

County City Leaders Push Back Against Proposed Mileage Tax

California S Road Usage Charge Pilot Program Stirs Controversy The Coast News Group

Mileage Tax Study Not Actual Mileage Tax Proposed In Infrastructure Bill Ap Berkshireeagle Com

Opinion San Diego Drivers Shouldn T Be Taxed On The Miles They Drive Times Of San Diego